Mathematics & Fintech

innovation in investing

Since the work of Nobel Laureates Markowitz, Sharpe, Merton, Scholes and others, quantitative analysis has become an increasing actor in the world of finance. With the latest developments in data science and machine learning, mathematics has moved to the forefront of much of contemporary investing.

In a post-COVID world, public policies, stakeholder interests and regulation are bringing social issues to the forefront of financial markets. ESG, climate risk, CO2 emissions, biodiversity and, in general, the 17 sustainability targets of the United Nations are changing the financial landscape in a way never seen before. Data science, machine learning and artificial intelligence are becoming the best technological allies to these challenges, and a substantial part of my activity is focused on that.

Director MMF

One of the leading Professional Master’s program in Quantitative Finance.

Chair, Centre for Sustainable Development

The Centre for Sustainable Development brings together research activity in areas such as smart villages, smart communities, climate risk, Environmental, Social & Governance (ESG) investing and other themes related to sustainability. The Centre draws on the mathematical strength of the Fields community as well as partnerships with a diverse collection of organizations who are involved and interested in the sustainability problem overall.

Visiting Fellow, ADIALab

BIO

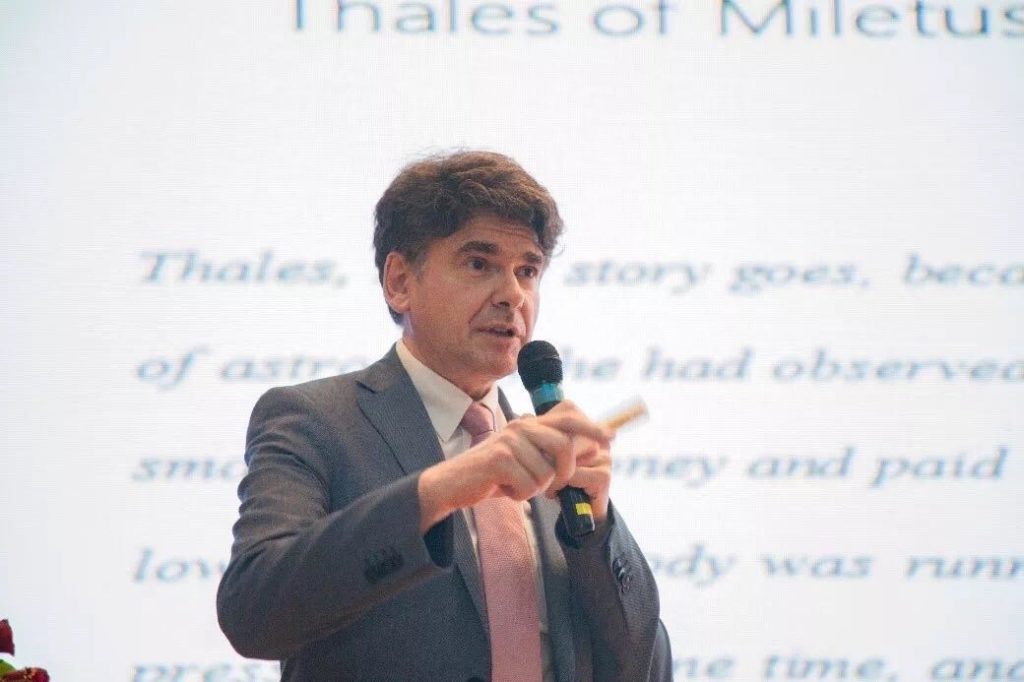

Prof. Luis Seco is the Director of the Mathematical Finance Program, Professor of Mathematics at the University of Toronto and director of Risklab, a university research laboratory established in 1996, conducting research in quantitative finance, with special focus on asset management. Prof. Seco’s current activity is focused on sustainability, including climate risk, and is simultaneously the Chair of the Centre for Sustainable Development at the Fields Institute, and affiliate Faculty member at the Vector Institute for research in Machine Learning; Prof. Seco’s core activity is bringing artificial intelligence into today’s sustainability challenges to build a new better world for future. He has authored papers in artificial intelligence and environmental scores, and currently is expanding that work to analyze CO2 emissions and carbon trades using machine learning. He was appointed ADIALab Fellow in 2022 and is the co-founder of Feishu, the partner of the Fields Institute in China.

His expertise has been in developing University-Industry relationships, which he has done since 1996. In October 2007, he won the NSERC – Natural Sciences and Engineering Research Council of Canada -Synergy Award for Innovation for his achievements. The award was delivered by Dr. Colin Carrie, Parliamentary Secretary to the Minister of Industry, on behalf of the Honourable Jim Prentice, Minister of Industry and Minister responsible for the Natural Sciences and Engineering Research Council of Canada (NSERC), and by Dr. Suzanne Fortier, President of NSERC. In 2011 was admitted Caballero de la Orden del Mérito Civil (Knight of the Order of Civil Merit), an award from the Government of Spain for his application of mathematics to foresee economic cycles

He was a co-founder and CEO Sigma Analysis & Management Ltd., an asset management firm that invested institutional money in liquid alternative investments for twenty years.

Today, Prof. Seco business partners include several International pension and sovereign wealth funds, the FIT Centre, RiskLab Centre Inc. and Metaversitas Inc. to address challenges and achieve an innovation agenda. His vision is to leverage the University network worldwide to promote training and research broadly in the areas where technology and innovation joins finance bringing them together, including education, health, climate risk and sustainability.

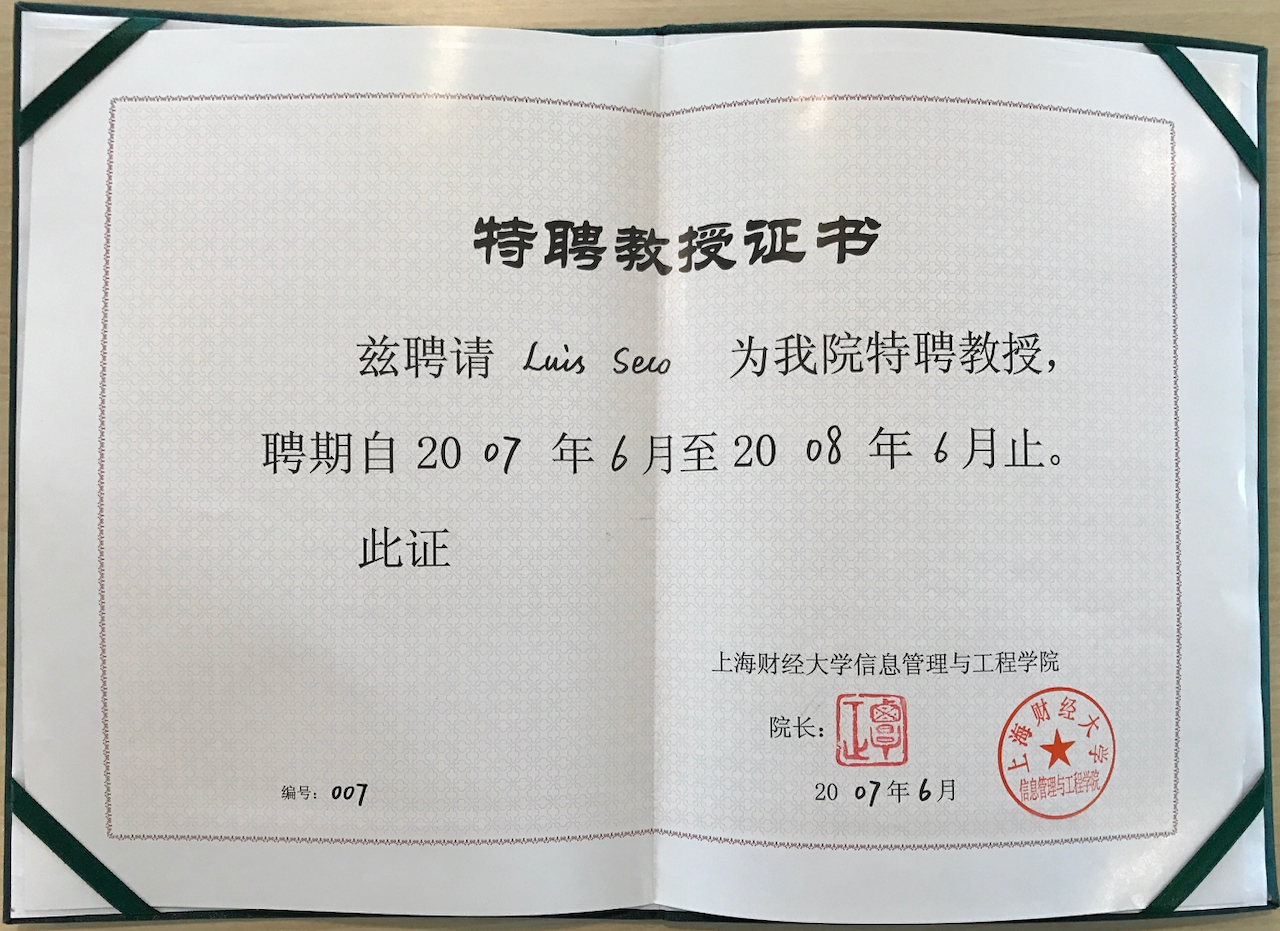

Luis Seco ’s career started at Princeton University in 1985, and landed at the University of Toronto in 1992 after a short stay at the California Institute of Technology. Today, he holds adjunct appointments at Renmin University in Beijing, Florida International University, the Technical University of Munich, the University of Zurich and Kutaisi International University.

(Conference organizers are permitted to include elements from my bio, or pictures from this site, in conference communications)

training and research

I believe that the challenges to build a successful career goes through practical training to allow individuals to adapt to a rapidly changing environment. MMF, RiskLab and the FIT Centre are devoted to transform individuals and corporations in the talent development area and in building career services.

commercial solutions

The investment sector is being disrupted by an intense internal technology vortex. Problems arising from ESG and climate solutions find answers in the commercial delivery of AI/ML solutions, such as the one by Risklab Centre, Metaversitas Inc. and SR.ai

the university of the future

The technology and social revolution does affect Universities too; innovative degrees, such as the MMF, which focus on learning for professional success are the way of the future.

FIT Centre and Risklab are positioned to bring the University network to new heights

Episodes

Synergy Award

In October 2007, RiskLab was the NSERC Synergy Award for Innovation. The award was delivered by Dr. Colin Carrie, Parliamentary Secretary to the Minister of Industry, on behalf of the Honourable Jim Prentice, Minister of Industry and Minister responsible for the Natural Sciences and Engineering Research Council of Canada (NSERC), and by Dr. Suzanne Fortier, President of NSERC.

Director of Fields-CQAM

Toronto, ON – July 5, 2019: The Fields Institute is pleased to announce the appointment of Professor Luis Seco as Director of the Fields Centre for Quantitative Analysis and Modelling (Fields CQAM) for a one year term, effective July 1, 2019. Dr. Seco will take over from Professor Huaxiong Huang, who led Fields CQAM since its establishment in 2018 and served as the Fields Institute Deputy Director from July 2016 to June 2019. Dr. Huang will return to his position as professor in the Department of Mathematics and Statistics at York University. [Read]

Shanghai University of Financial Economics

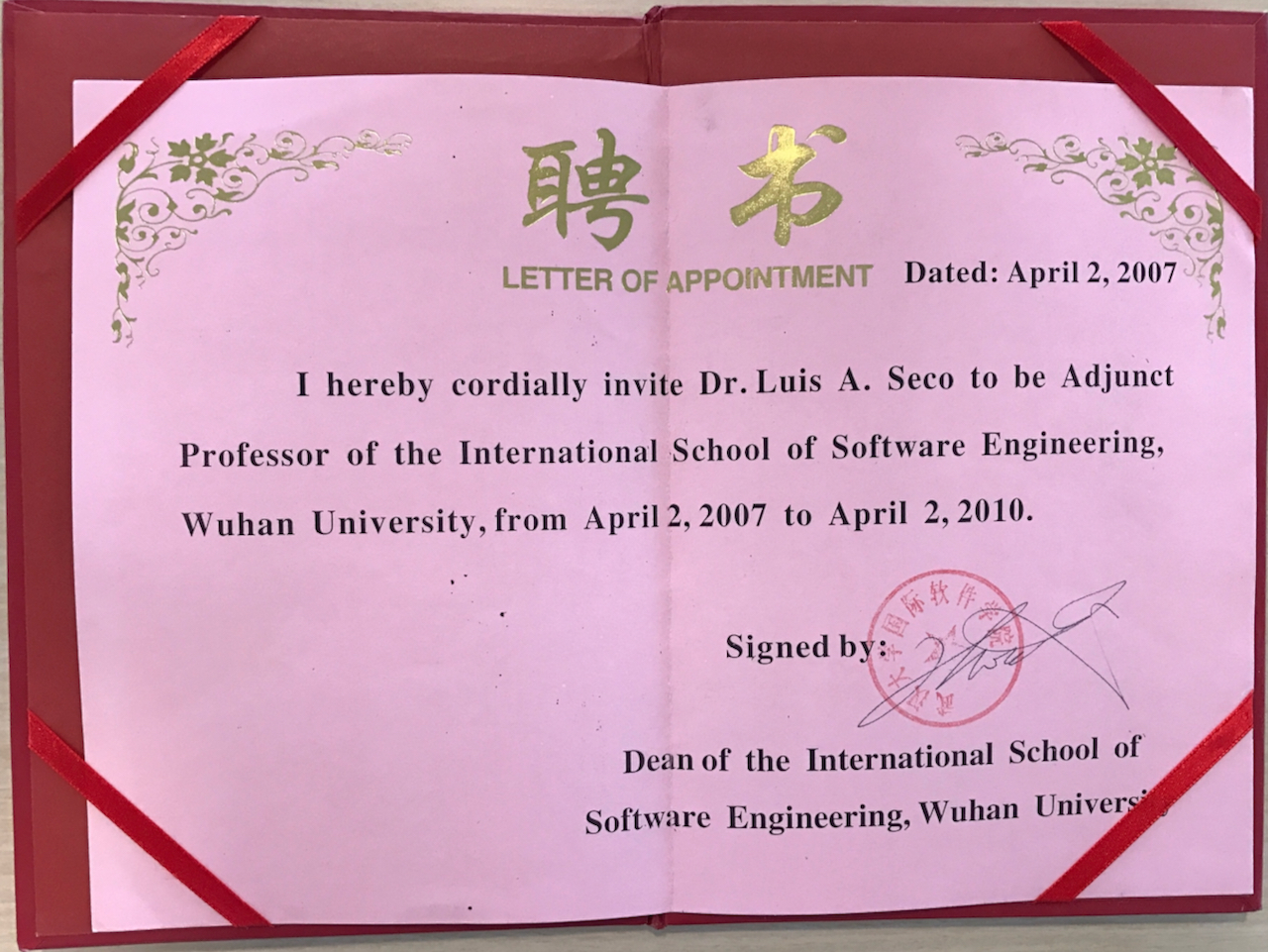

Software Engineering, Wuhan University

Editorial work

I serve on the editorial board of several publications dedicated to mathematics and financial risk management

“Confidence is going after Moby Dick in a rowboat and taking the tartar sauce with you.”

― Zig Ziglar

Risk Management in Financial Institutions

Journal of Risk Management in Financial Institutions is the essential professional and research journal for all those concerned with the management of risk at retail and investment banks, investment managers, broker-dealers, hedge funds, exchanges, central banks, financial regulators and depositories.

Asia-Pacific Journal of Operational ResearchVol. 28, No. 01 (2011)

Risks are traditionally defined as the combination of probability and severity, but are actually characterized by additional factors. We believe the characteristics of risks include uncertainties, dynamics, dependence, clusterings and complexities, which motivate the utilization of various operational research tools. The objective of this issue is to survey the practice of using operational research tools in risk management, especially Asian risk management.

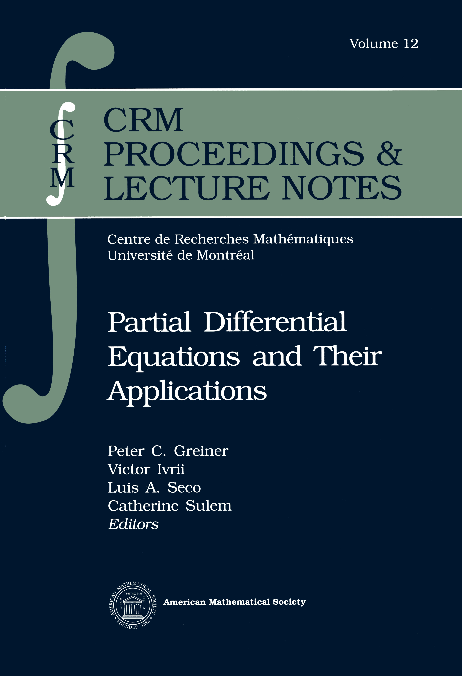

Partial Differential Equations and Their Applications

A co-publication of the AMS and Centre de Recherches Mathématiques

This volume presents lectures given at the 1995 Annual Seminar of the Canadian Mathematical Society on Partial Differential Equations and Their Applications held at the University of Toronto in June 1995.

Trading & Risk Magazine

A publication of RiskMathics, the training and trading company based in Mexico, a leader in trading education in LatAm.